(Image source from: Canva.com)

Gold prices reached their highest level ever on Friday after the United States decided to add tariffs on gold bars. This action caused a significant increase in global prices, which was also seen in India. Silver prices have risen as well, now trading over Rs 1.15 lakh per kilogram. US media sources reported that 1 kg and 100-ounce gold bars have been put into a tariff category with increased import fees. This choice is anticipated to greatly affect worldwide trade, particularly for nations like Switzerland, which is a key player in gold refining and exports. The news agency Reuters noted that the difference between future and spot prices expanded to more than $100 after the Financial Times said the US had set tariffs on imports of 1-kg gold bars, referring to a letter from Customs and Border Protection dated July 31. The letter indicated that 1-kg and 100-ounce gold bars should be grouped under a customs code with higher duties.

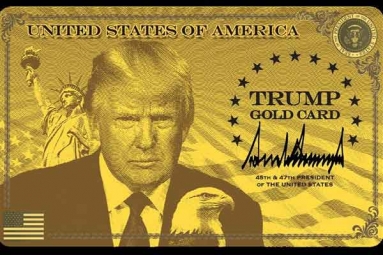

On Thursday, US President Donald Trump's increased tariffs on imports from numerous countries took effect, causing major trade partners to quickly look for better arrangements. Market experts think this action could disrupt financial transactions and the flow of gold trade, leading investors to turn to gold, which is often seen as a safe investment. This has resulted in more purchases in both international and local markets.

Various reasons are leading to the rise in gold prices:

- US tariffs on gold bars

- A weaker US dollar

- Market predictions of a possible US Federal Reserve interest rate decrease

- Increasing global demand due to economic uncertainty

- Gold continues to be regarded as a reliable safe-haven investment, especially during unstable economic times.

Over the last 20 years, gold has provided a return of more than 1,200%. It has increased from about Rs 7,638 in 2005 to over Rs 1,02,000 in 2025. This year alone, it has risen by roughly 31%, making it one of the top-performing asset categories of 2025.