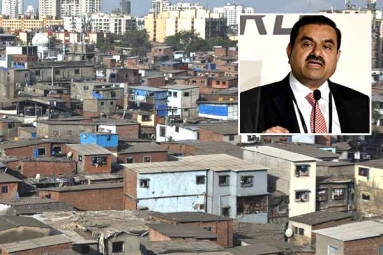

(Image source from: Millenniumpost.in)

This year, the Adani Group has claimed the title of the fastest-growing Indian brand, as its brand value has increased by 82 percent, as reported by a recent study. The impressive growth of the Group is attributed to a strong emphasis on infrastructure development, a rise in ambitions related to green energy, and a boost in brand recognition among essential stakeholders, according to the “Most Valuable Indian Brands 2025” report conducted by Brand Finance, which is based in London. Gautam Adani, the chairman of Adani Group, shared on X, “I am thrilled to announce that Adani Green has exceeded 15,000 MW in renewable energy capacity, achieving the largest and quickest expansion of green energy in India’s history. From the arid plains of Khavda to a commendable position among the world's Top 10 Green Power Producers, this achievement symbolizes not just a figure but our dedication to the environment and our determination to propel India’s green revival!”

The value of the Adani brand escalated from $3.55 billion in 2024 to $6.46 billion, denoting a remarkable increase of $2.91 billion. This rise showcases the Group’s strategic insights, resilience, and pledge toward sustainable development. The growth this year exceeded the total brand valuation reported in 2023, allowing the Adani Group to ascend from the 16th to the 13th position, as per the findings. The company has recorded unprecedented revenues, exceptional growth, and historic profitability. During this week’s 33rd Annual General Meeting (AGM) of Adani Enterprises Ltd (AEL), Mr. Adani stated, “Our figures for FY25 were impressive. In all of our sectors, we went beyond mere expansion. We made an impact, fostered change, and, importantly, strengthened our national commitment.”

Looking at the consolidated figures, the Group experienced a 7 percent increase in revenues, an 8.2 percent rise in EBITDA, and maintained a healthy Net Debt-to-EBITDA ratio of 2.6x. Total revenues reached Rs 2,71,664 crore, with adjusted EBITDA amounting to Rs 89,806 crore. “Our capital investments across various businesses are on track to set new records. We expect an annual capital expenditure of $15-20 billion over the next five years. These investments not only focus on our Group but also aim to contribute to building India’s infrastructure,” remarked Mr. Adani. Adani Power has generated over 100 billion units—an unprecedented achievement for any private company—and is well-positioned to reach 31 GW capacity by 2030. In other developments, the collective brand value of the top 100 Indian firms has reached $236.5 billion so far in 2025, highlighting a resilient economy amid strong policies. The Brand Finance rankings reflect stable results, indicating a year of consistent growth for significant Indian brands across multiple sectors.